What Is Psychotrading?

The trading is a practice or activity that involves analyzing and studying the financial markets, in order to obtain an economic benefit. But if we want to be successful in this sector, we must have good emotional management ; and that’s where psychotrading or trading psychology comes in .

The truth is that psychology has tools applied to almost all sectors, and this includes the financial sector. But what else do we know about psychotrading ? What else does it have to do with and what factors make proper psychotrading difficult ? Let’s find out!

What is psychotrading?

The term psychotrading does not appear in academic dictionaries. Also called trading psychology , it is a concept created within the financial markets, specifically in the world of trading . For its part, trading is ‘speculation on financial instruments with the aim of making a profit’.

The trading is based on different strategies: technical analysis, fundamental analysis and implementation of a specific strategy to operate. But let’s go back to psychotrading ; What exactly is it about?

We could say that it is the study of all those processes, perceptions and sensations that influence our behavior when trading.

Control of emotions

The psicotrading has a lot to do with emotional control when operating in trading . It would be the psychological part of this professional activity.

It is important to know that traders , people who are dedicated to trading , always have (like all people) an irrational facet that dominates them in the most delicate moments. In order to work on this, that is, reducing that irrational part to enhance the more logical and analytical part of the brain, psychotrading is applied .

The three pillars of trading

Those who know the sector explain that psychotrading , or trading psychology , is one of the necessary pillars to achieve success in the financial markets. But, beyond psychology, what does it take to be successful in trading ? According to experts in the field, there would be three key factors for this:

- Have a trading system tested and adapted to your own needs.

- Have adequate monetary management that allows us to stay (“survive”) in the market during periods of losses.

- Having adequate psychological conditions that allow us to successfully deal with two elements: the financial markets and ourselves.

As we can see, the third point has to do with psychotrading . On the other hand, we can adapt the first two points and carry them out with the help of statistics and probability, which provide us with objective indexes.

Key psychological factors in psychotrading

According to several experts in this field, proper emotional management (which includes good emotional control ) is essential to be successful in trading . From this psychological aspect, and beyond the emotional management, we found some key factors that must be worked to perform trading successfully.

Remember that trading consists of analyzing and studying the financial markets to obtain an economic benefit. Thus, four important psychological elements stand out for good trading :

- Patience.

- The resilience.

- Self-confidence.

- Self-control.

Enemies of psychotrading

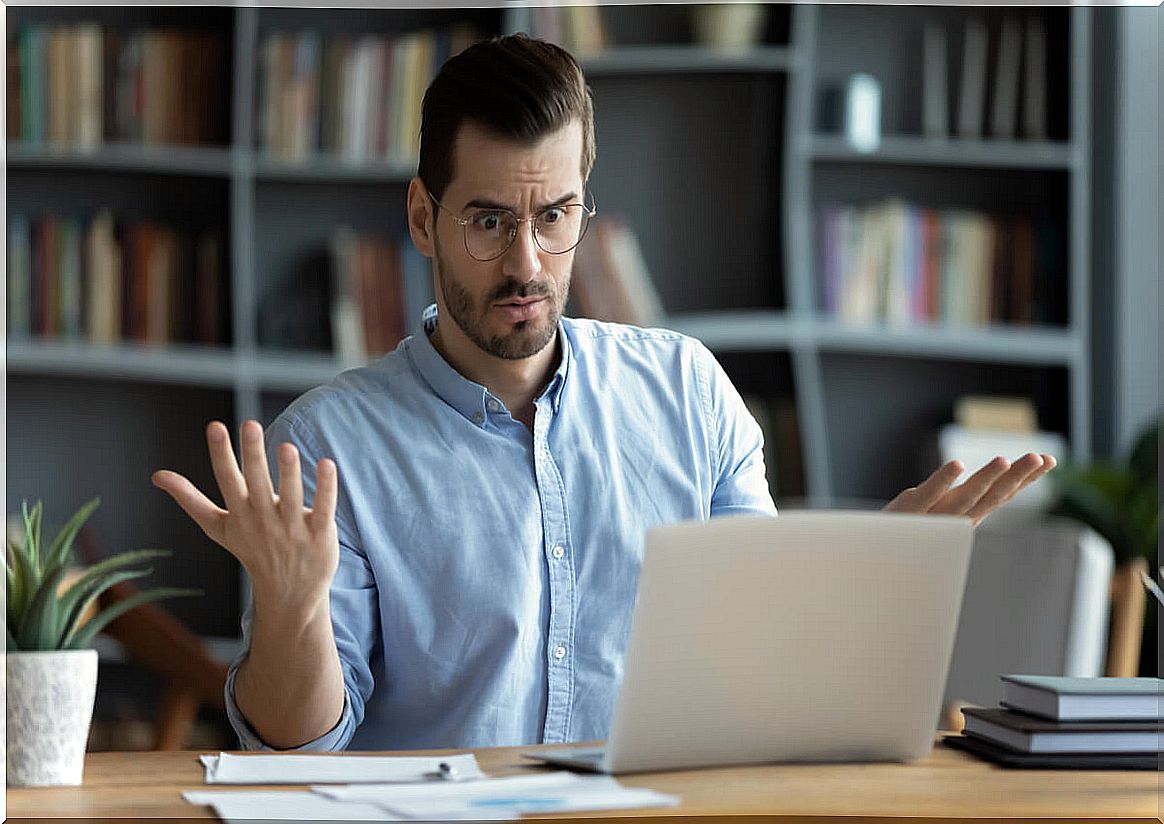

What prevents traders from being successful in their trades? To begin with, a lack of psychotrading techniques applied in trading operations . On the other hand, the lack of psychological control can also lead us to fail in our financial analysis. Why?

Because when feeling anger, for example, we can develop feelings of revenge that can lead us to lose a lot of money. On the other hand, skipping the trading plan , excess trading or operating non-stop are other types of behaviors that traders can manifest and that can also lead to economic losses. Other more specific enemies of psychotrading that we find are the following:

- Fear : for example, fear of missing the precise moment of entering or exiting a trade (which is known as FOMO, a very interesting concept as well).

- Greed : those who operate daily in trading have a greater risk of developing it; greed makes us generate irrational operations not present in the initial plan.

- Euphoria : it is an emotion that can lead us to carry out risky operations. It is good to feel euphoria but we should not allow it to dominate us because then our most irrational part is activated.

How to combat the enemies of psychotrading?

How can we act so that the enemies of psychotrading do not interfere in our professional practice? Basically, through good emotional control.

And how to improve in trading , beyond psychology? Here are some ideas that mix psychotrading with more technical strategies of the profession:

- Be able to lose.

- Stick to the initial trading plan as much as possible .

- Control risks, carry out good capital management and thoroughly analyze the markets.

- Constantly improve through: reading, listening, interacting with other traders …

- Take breaks and disconnect from time to time from the world of trading.

And you, did you know psychotrading ? What do you think? Do you find it useful to apply psychology in different professions, regardless of the sector?

Psychology has to do with emotions, and we all know that emotions influence our behaviors and our decision making. Therefore, in an area such as trading , being able to manage them can be very useful.